August 26, 2022

Home Sales Are Slowing, But The Housing Market Remains On Solid Ground

Just a few months ago, the housing market was surging: home prices were up, rates were down, and demand was out of control.

We’re now starting to see a different story unfold. In July, existing home sales fell for the sixth month in a row, with numbers down 5.9% month over month and 20% compared to July 2021. And with more layoffs and slower growth in the job market, Americans who were once eager to jump into homeownership and reap the benefits of record appreciation are now deciding to sit on the sidelines in the face of interest rate increases.

In addition to higher rates, fears of an economic recession are also keeping once-hopeful buyers from entering the market. The news about declining sales and rising inventory have many worried that housing market of the last two years was in fact a bubble that is finally is ready to burst.

However, if you look at the fundamentals behind why the housing market is in the state that it is – and compare it to markets of the past – it’s clear that we are on very stable ground and housing will continue to be a safe investment.

Appreciation Will Slow, But Keep Moving Upward

The memory of the last housing boom and bust is still fresh in the minds of homeowners. With how sharply prices have risen in the past year, there is plenty of concern out there about how and when this boom will end.

According to Greg McBride, Chief Financial Analyst at Bankrate, we will will probably see a price plateau in the near future, but the likelihood of prices falling is unlikely.

“While the recent pace of home price appreciation isn’t sustainable over the long run, that doesn’t mean prices are at risk of a sharp drop. Real estate prices can move in big spurts — like now — and then show relatively little change over a period of years. A plateauing of prices is the more likely outcome.” – McBride

A slowdown like this would means there is more of a chance that buyers will see more normal buying experiences. In some markets, a slowdown would mean less competition and more likelihood that sellers will accept offers that come with contingencies (like the buyer having to sell their own home first).

What About The Coming Recession?

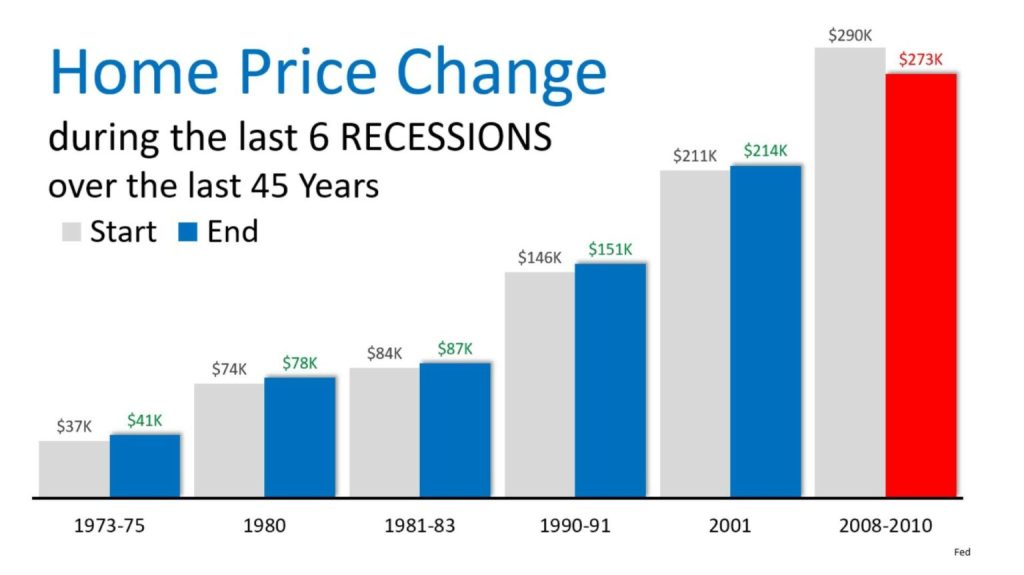

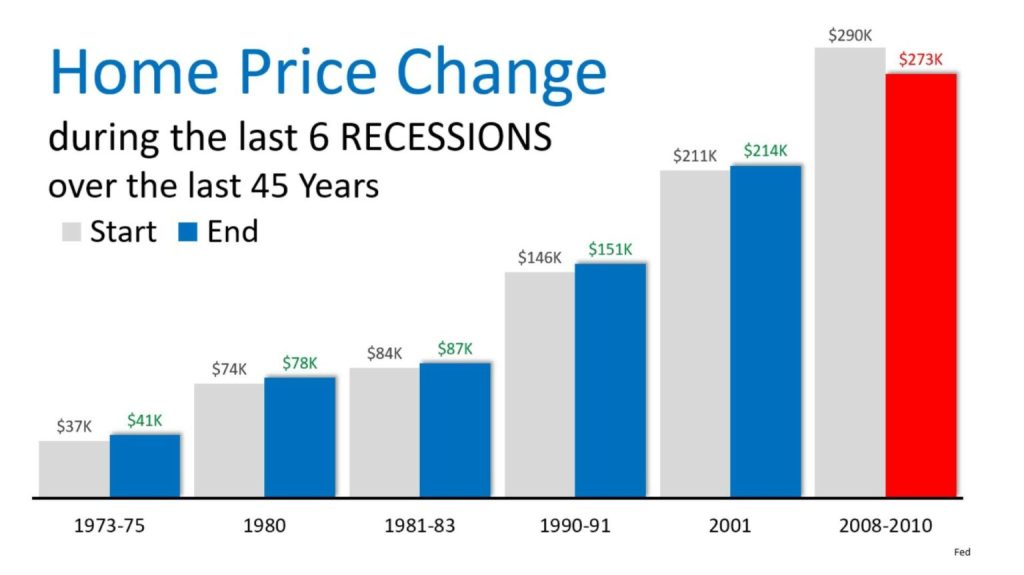

If you are worried about how home prices will hold up once we enter a recession, take a look at the chart below showing home price change during the last six U.S. recessionary periods.

With the Great Recession as the outlier, housing has always done well during recessionary periods. This was even the case during the COVID-19 recession in 2020, when home prices rose by 6%.

5 Reasons the Housing Market Will Remain Stable

Housing economists agree that there is no catastrophic crash on the horizon for five major reasons:

1. Record-low inventory

According to the National Association of Realtors, there was just a 3.3-month supply of homes for sale in July. The supply-and-demand equation simply won’t allow a price crash in the near future.

2. Builders can’t build fast enough

Home builders pulled back after the last crash, and they never fully ramped up to pre-2007 levels. Now, there’s no way for them to buy land and win regulatory approvals quickly enough to quench demand.

3. New buyers are consistently entering the market

The pandemic and resulting rise in people working remotely led many Americans to look at upgrading their living spaces. This movement is still is still playing out today. Millennials are also a very large group that are entering their homebuying years in droves.

4. Lending standards remain strict

Today, lenders impose very rigourous borrowing standards on potential buyers. The people who are able to get a mortgage have high credit and guaranteed, verifiable income.

5. Foreclosure activity is still historically low

While foreclosures have started to rise as forbearance plans come to an end, foreclosure activity is still far below the average. Most homeowners also have a comfortable equity cushion in their homes that they can fall back on.

The Bottom Line

Slowing home sales are nothing to worry about. The market will start to cool down as we move toward a recession, but low inventory, high demand, and strict lending standards mean real estate will continue to be a safe investment. This is only good news for buyers, as less competition will make finding a home in your price range and realizing the benefits of appreciation that much easier.

If you would like to take advantage of this slowing market, fill out the form below to request a consultation with one of our mortgage advisors and start your homebuying journey.

With the Great Recession as the outlier, housing has always done well during recessionary periods. This was even the case during the COVID-19 recession in 2020, when home prices rose by 6%.

With the Great Recession as the outlier, housing has always done well during recessionary periods. This was even the case during the COVID-19 recession in 2020, when home prices rose by 6%.